Empirical data on ISDS in the CIS: who are the main winners and losers?

The CIS Arbitration Forum conducted an empirical study on the performance of States in the CIS region in known investor-state disputes between 1996 and June 2020. It shows the growth patterns of the disputes, highlights notable features of their outcomes, and identifies trends regarding the State of investor origin and nationality of arbitrators.

The research was conducted in two phases. The first phase concerned the location of publically available decisions in major databases, including Italaw, Jus Mundi, the ICSID Cases Database, and the UNCTAD Investment Dispute Settlement Navigator. The second phase addressed the production and visual representation of statistical data presented in this report.

Strictly speaking, not all States covered in the report are members of the CIS (Commonwealth of Independent States). For the purposes of this report, we analyzed the performance of all former Soviet Union republics which are currently not members of the European Union. Below we present the key findings of the study.

The overall number of cases: respondents

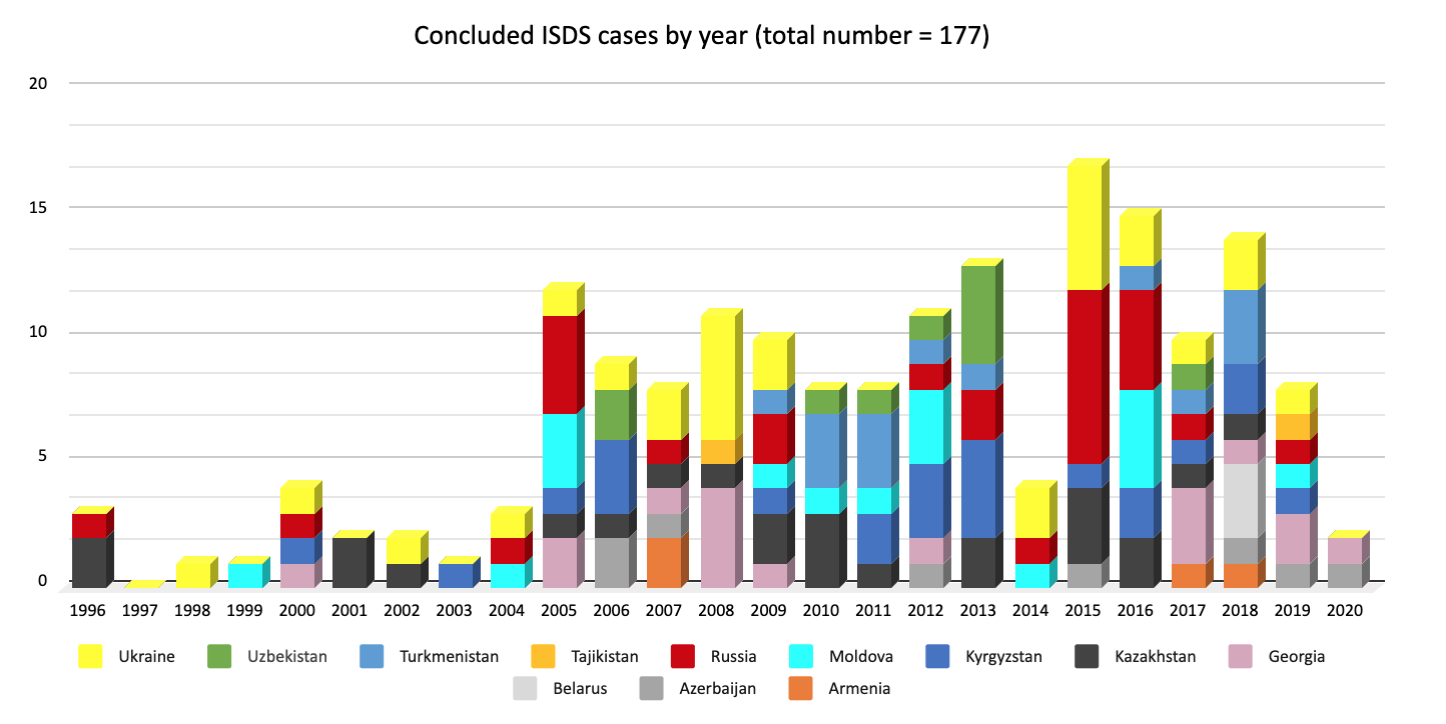

From the mid-1990s investor-state tribunals resolved only a handful of cases resolved. However, in the 2000s, the region has seen a significant increase in the number of investor-state disputes. The biggest spike in cases occurred in 2015, where over 50% of the total number of cases were filed against Russia, some resulting from the Russia-Ukraine conflict.

The lowest number of cases were brought in the late 1990s and early 2000s. The cases brought in the first half of 2020 have reached the lowest number for the past ten years, undeniably as a result of the impact caused by COVID-19.

Outcomes in known treaty-based ISDS cases

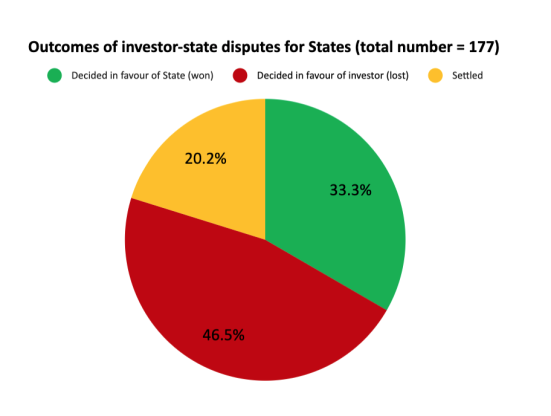

Investors prevailed in 47% of all cases asserted against states in the region, which is much higher compared to the total number of worldwide investor-state disputes, where investors prevail only in 29% according to UNCTAD.

Please note that you can sort the values in this spreadsheet.

Ukraine, Kazakhstan and Moldova won more cases than lost. But the number of cases they won is roughly the same as the number of cases they lost and settled. Georgia, Kyrgyzstan and Russia lost more cases than they won. Turkmenistan and Georgia lost as many cases as they settled. Armenia, by contrast, won as many cases as it settled.

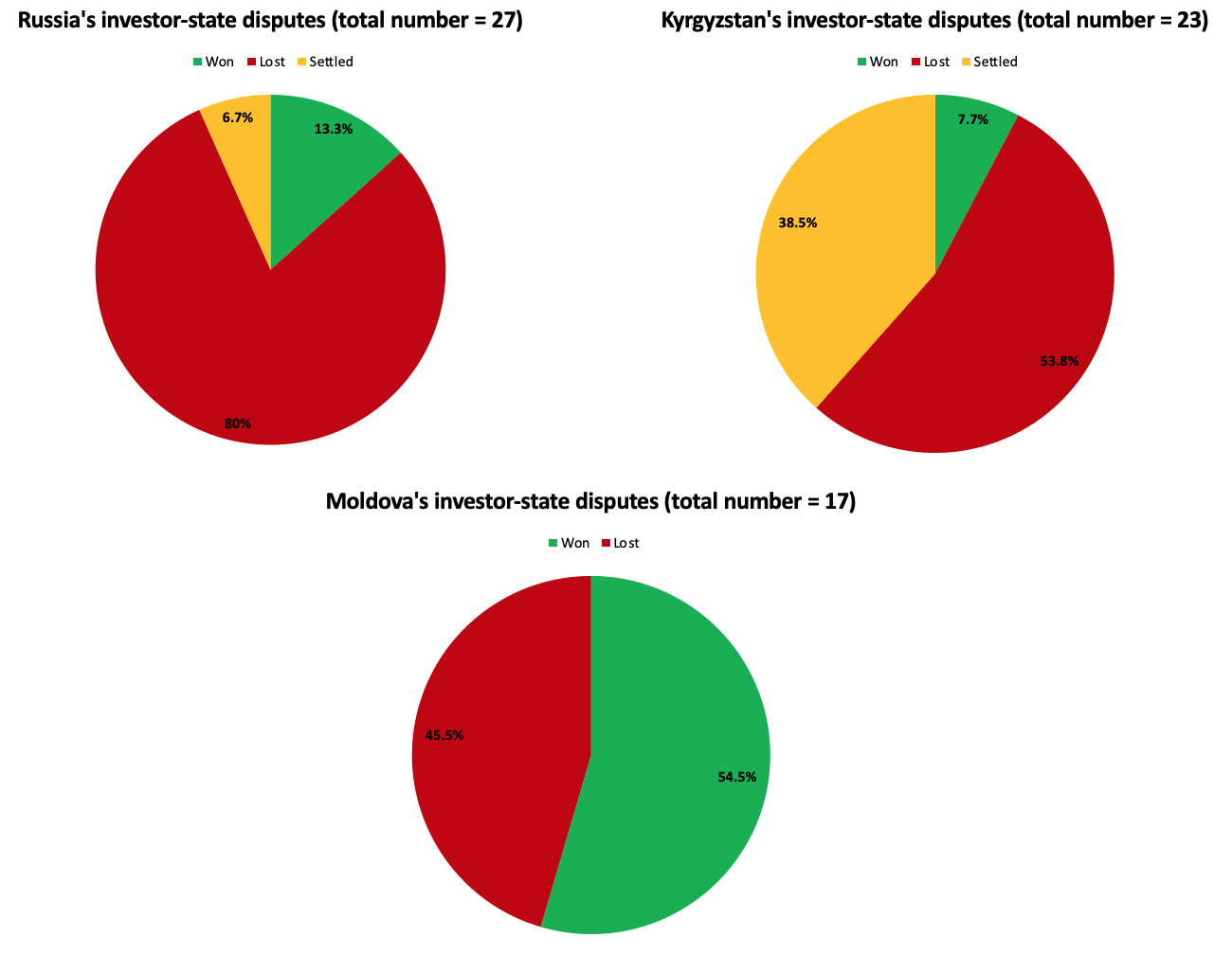

Only two States lost more than half of all their cases. Russia has by far the highest number and percentage of cases lost (12 cases, accounting for 80% of all cases). The second worst performer is Kyrgyzstan, which lost around 54% of its cases. If we also include the number of cases Kyrgyzstan had to settle, the total reaches the staggering 92% of all cases.

It is surprising that Kyrgyzstan comes in as the fourth with almost the same number of cases as Ukraine. Its economy (measured by GDP) is the second smallest in the region but the number is unusually high. Kyrgyzstan also has the highest number of cases settled, followed by Georgia. An overview of the most recent proceedings brought against Kyrgyzstan can be found here.

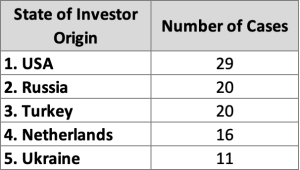

States of investor origin

Our analysis suggests that between 1996 and 2020 the top five States of Investors include the United States, Russia, Turkey, the Netherlands, and Ukraine. These findings make sense as the United States remains the largest economy in the world while Turkey is the largest economy of the Turkic countries, which include Azerbaijan, Kazakhstan, Kyrgyzstan, Turkmenistan and Uzbekistan. Russia and Ukraine are the biggest economies of the region while the Netherlands is known for a place with a favorable climate for the incorporation of investors from around the world, who then invest in the region.

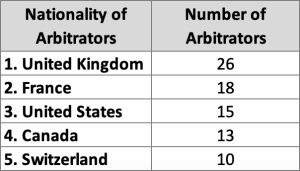

Nationality of arbitrators

As a final point, it is noteworthy that the top five nationalities of appointed arbitrators are from Western European or North American States. These account for almost 60% of all appointments. The data demonstrates that not a single appointment was made of nationals of the former Soviet Union republics which are currently not members of the European Union. The parties to the proceedings and arbitral institutions, therefore, continue the practice of refraining from introducing arbitrators from the analysed region.

Trends and future outlook

This report identified a number of important trends of CIS-related investor-state disputes. Ukraine, Russia and Kazakhstan as the biggest economies of the region attracted the largest number of cases. The number of States has been constantly growing and some States faced mixed results, with Russia losing the largest number of cases in absolute terms and Kyrgyzstan being the worst performer in relative terms.

American, Russian and Turkish investors are likely to continue to actively rely on the system of investor-state dispute settlement, but we may see more disputes where both the investor and the State come from the CIS region as the number of cases brought by Ukrainian investors is growing.

Nationals of Western Europe and North America dominate appointments, yet this is likely to change as the number of highly qualified lawyers from the CIS region continues to grow.

Yarik Kryvoi & Annabelle Pröpstl